Under the general permission available, the following categories can freely purchase immovable property in India:

a. at any time, held Indian passport, or

b. who or his/her father or grandfather was a citizen of India by virtue of the Constitution of India or the Citizenship Act, 1955 (57 of 1955).

The general permission, however, covers only purchase of residential and commercial property and not for purchase of agricultural land/plantation property/farm house in India.

There are no restrictions on the number of residential/commercial properties that can be purchased.

A foreign company which has established a branch office or other place of business in India, can acquire any immovable property in India, which is necessary for or incidental to carrying on such activity. The payment for acquiring such a property should be made by way of foreign inward remittance through proper banking channel. On winding up of the business, the sale proceeds of such property can be repatriated only with the prior approval of Reserve Bank.

However, if the foreign company has established a liaison office, it cannot acquire immovable property. In such cases, liaison offices can take property by way of lease not exceeding five years.

Yes, NRIs and PIOs can freely acquire immovable property by way of a gift either from:

However, the property can only be commercial or residential. Agricultural land/plantation property/farm house in India cannot be acquired by way of gift. (b) A foreign national of non-Indian origin resident outside India cannot acquire any immovable property in India through a gift.

Yes, a person resident outside India i.e.,

A person resident outside India (i.e. NRI or PIO or foreign national of non-Indian origin) can inherit immovable property from

(a) a person resident in India.

(b) a person resident outside India However, the person from whom the property is inherited should have acquired the same in accordance with the foreign exchange regulations applicable at that time.

A. Transfer by sale Can an NRI/PIO/foreign national sell his residential/commercial property?

(a) NRI can sell property in India to:

(b) PIO can sell property in India to

(c) Foreign national of non-Indian origin including a citizen of Pakistan or Bangaladesh or Sri Lanka or Afghanistan or China or Iran or Nepal or Bhutan can sell property in India with prior approval of the Reserve Bank of India to:

(a) NRI/PIO may sell agricultural land/ plantation property/farm house to a person resident in India who is a citizen of India.

(b) Foreign national of non-Indian origin resident outside India would need prior approval of the Reserve Bank of India to sell agricultural land/plantation property/farm house

A. Transfer by gift.

Yes

(a) NRI/PIO may gift residential/commercial property to

(b) a foreign national of non-Indian origin needs prior approval of the Reserve Bank of India.

(a) NRI/PIO can gift but only to a person resident in India who is a citizen of India.

(b) foreign national of non-Indian origin needs prior approval of the Reserve Bank of India.

(a) an authorised dealer/housing finance institution in India without the approval of the Reserve Bank of India.

(b) a party abroad with prior approval of the Reserve Bank of India.

Payment can be made out of

No payment can be made either by traveller’s cheque or by foreign currency notes. No payment can be made outside India.

Refunds, together with interest (net of income tax) can be credited to NRE account. This is subject to condition that the original payment was made by way of inward remittance or by debit to NRE/FCNR(B) account.

Can NRI/PIO avail of loan from an authorised dealer for acquiring flat/ house in India for his own residential use against the security of funds held in his NRE Fixed Deposit Account/FCNR (B) Account?

Yes. However, banks cannot grant fresh loans or renew existing loans in excess of Rs 20 lakh against NRE and FCNR (B) deposits either to the depositors or to third parties. Such loans can be repaid

(a) by way of inward remittance through normal banking channel or

(b) by debit to NRE/FCNR (B)/NRO accounts

(c) out of rental income from such property.

(d) by the borrower’s close relatives.

In case the amount has been received from inward remittance or debit to NRE/FCNR(B)/NRO account for acquiring the property or for repayment of the loan, the principal amount can be repatriated outside India.

In case the property is acquired out of rupee resources and/or the loan is repaid by close relatives in India, the amount can be credited to the NRO account of the NRI/PIO. The amount of capital gains, if any, arising out of sale of the property can also be credited to the NRO account. NRI/PIO are also allowed by the authorised dealers to repatriate an amount up to $1 million per financial year out of the balance in the NRO account for all bonafide purposes to the satisfaction of the authorised dealers, subject to tax compliance.

Can NRI/PIO, avail of housing loan in rupees from an authorised dealer or housing finance institution in India approved by the National Housing Bank for purchase of residential accommodation or for the purpose of repairs/ renovation/improvement of residential accommodation? How can such loan be repaid?

Yes, NRI/PIO can avail of housing loan in rupees from an Authorised Dealer or housing finance institution subject to certain terms and conditions. Such a loan can be repaid

(a) by way of inward remittance through normal banking channel or

(b) by debit to his NRE/FCNR (B)/NRO account or

(c) out of rental income from such property.

(d) by the borrower’s close relatives, as defined in section 6 of the Companies Act, 1956, through their account in India by crediting the borrower’s loan account.

Yes, subject to certain terms and conditions.

If so, what are the terms? NRI/PIO may repatriate the sale proceeds of immovable property

(a) If the property was acquired out of foreign exchange sources i.e. remitted through normal banking channels/by debit to NRE/FCNR (B) account.The amount to be repatriated should not exceed the amount paid for the property:

1. in foreign exchange received through normal banking channel

2. by debit to NRE account (foreign currency equivalent, as on the date of payment) or debit to FCNR (B) account. Repatriation of sale proceeds of residential property purchased by NRI/PIO out of foreign exchange is restricted to not more than two such properties. Capital gains, if any, may be credited to the NRO account from where the NRI/PIO may repatriate an amount up to $1 million, per financial year, as discussed below.

(b) If the property was acquired out of Rupee sources, NRI or PIO may remit an amount up to $1 million, per financial year, out of the balances held in the NRO account (inclusive of sale proceeds of assets acquired by way of inheritance or settlement), for all the bonafide purposes to the satisfaction of the Authorized Dealer bank and subject to tax compliance.

From the NRO account, NRI/PIO may repatriate up to $1 million per financial year (April-March), which would also include the sale proceeds of immovable property.

Yes, provided the loan has been subsequently repaid by remitting funds from abroad or by debit to NRE/FCNR(B) accounts. If the property was purchased from foreign inward remittance or from NRE/FCNR (B) account, can the sale proceeds of property be repatriated immediately? Yes

The sale proceeds of immovable property acquired by way of gift should be credited to NRO account only. From the balance in the NRO account, NRI/PIO may remit up to $1 million, per financial year, subject to the satisfaction of Authorised Dealer and payment of applicable taxes.

Yes, general permission is available to NRIs/PIO to repatriate the sale proceeds of the immovable property inherited from a person resident in India. NRIs/PIO may repatriate an amount not exceeding $1 million, per financial year, on production of documentary evidence in support of acquisition/inheritance of assets, an undertaking by the remitter and certificate by a Chartered Accountant.

In case of a foreign national, sale proceeds can also be repatriated even if the property is inherited from a person resident outside India. But this is allowed only with prior approval of the Reserve Bank of India (RBI). The foreign national has to approach the RBI with documentary evidence in support of inheritance of the immovable property and the undertaking and the C.A. Certificate as mentioned above. The general permission for repatriation of sale proceeds of immovable property is not available to a citizen of Pakistan, Bangladesh, Sri Lanka, China, Afghanistan and Iran and he/she has to seek specific approval of the RBI.

Can foreign embassies/diplomats/ consulate generals purchase/sell immovable property in India? Yes, foreign embassies/ diplomats/consulate generals can purchase and sell any immovable property other than agricultural land/plantation property/farm house in India with prior clearance from the Government of India, Ministry of External Affairs. The payment should be made by foreign inward remittance through normal banking channels.

Can NRI/PIO rent out the residential/commercial property purchased out of foreign exchange/rupee funds? Yes, NRI/PIO can rent out the property without the approval of the RBI. Rent received can be credited to NRO/NRE account or remitted abroad. Powers have been delegated to the Authorised Dealers to allow repatriation of current income like rent, dividend, pension, interest, etc. of NRIs/PIO who do not maintain an NRO account in India based on an appropriate certification by a chartered accountant, certifying that the amount proposed to be remitted is eligible for remittance and that applicable taxes have been paid/provided for.

Yes, he can continue to hold the residential/commercial property/ agricultural land/plantation property/farm house in India without the approval of the RBI.

The sale proceeds may be credited to NRO account.

Can the sale proceeds of the immovable property bought by a person when he was a resident be remitted abroad? Yes, provided the amount to be remitted does not exceed $1 million per financial year, for all bonafide purposes to the satisfaction of Authorised Dealers and subject to tax compliance.

Yes, they may continue to hold the immovable property. However, they can transfer the property only with the prior approval of the RBI.

A person resident in India who is a citizen of Pakistan or Bangladesh or Sri Lanka or Afghanistan or China or Iran or Nepal or Bhutan is governed by the provisions of the Foreign Exchange Management (Acquisition and Transfer of Immovable Property in India) Regulations, 2000. He would require prior approval of the RBI for acquisition and transfer of immovable property in India even though he is resident in India. Such requests are considered by the RBI in consultation with the Government in India.

Indian regulators are known to modify laws and regulations with nagging frequency. The best of investments decisions suffer due to sudden swings in regulations. The provisions related to foreign investment in real estate in India have been relatively stable and no pejorative changes have been effected therein in the recent past. That has perhaps facilitated the aggressive alteration of India’s skyline, due to large and outstanding building projects funded interalia, by foreign funds. It has not yet fully addressed the backlog of deficit in demand for space. Such long term deficit will always attract investment therein and returns will follow. So will NRIs.

The Foreign Exchange Management Act, 1999 (FEMA) empowers the Reserve Bank to frame regulations to prohibit, restrict or regulate the acquisition or transfer of immovable property in India by certain persons residents outside India. The regulations governing acquisition and transfer of immovable property in India is notified under Notification FEMA No.21/2000-RB of May 3, 2000, as amended from time to time.

A Non- Resident Indian (NRI)1

(i) Purchase of immovable property

A NRI can acquire by way of purchase any immovable property (other than agricultural land/ plantation property / farm house) in India.

(ii) Transfer of immovable property

A NRI may transfer any immovable property in India to a person resident in India. He may transfer any immovable property (other than agricultural land or plantation property or farm house) to an Indian Citizen resident outside India or a PIO resident outside India.

(iii) Payment for Acquisition of Immovable Property

NRIs can make payment for acquisition of immovable property (other than agricultural land/ plantation property / farm house) out of:

Funds received in India through normal banking channels by way of inward remittance from any place outside India or by debit to his NRE / FCNR(B) / NRO account. Such payments cannot be made either by traveller’s cheque or by foreign currency notes or by other mode except those specifically mentioned above.

(iv) A NRI who has purchased residential / commercial property under general permission is not required to file any documents with the Reserve Bank.

B Person of Indian Origin (PIO)2

(i) Purchase of immovable property

A PIO can acquire by way of purchase any immovable property (other than agricultural land/ plantation property / farm house) in India.

(ii) Gift/ Inheritance of immovable property

(a) A PIO may acquire any immovable property (other than agricultural land/ plantation property / farm house) in India by way of gift from a person resident in India or a NRI or a PIO.

(b) A PIO may acquire any immovable property in India by way of inheritance from a person resident in India or a person resident outside India who had acquired such property in accordance with the provisions of the foreign exchange law in force or FEMA regulations, at the time of acquisition of the property.

(iii) Transfer of immovable property

A PIO can transfer any immovable property in India (other than agricultural land / farm house / plantation property) by way of sale to a person resident in India.He may transfer agricultural land / farm house / plantation property in India, by way of gift or sale to a person resident in India, who is a citizen of India. He may also transfer residential or commercial property in India by way of gift to a person resident in India or to a person resident outside India, who is a citizen of India or to a Person of Indian Origin resident outside India.

iv) Payment for Acquisition of Immovable Property in India

A PIO can make payment for acquisition of immovable property in India (other than agricultural land / farm house / plantation property):

By way of purchase out of funds received by inward remittance through normal banking channels or by debit to his NRE / FCNR(B) / NRO account.

Such payments cannot be made either by traveller’s cheque or by foreign currency notes or by other mode other than those specifically mentioned above.

(v) A PIO who has purchased residential / commercial property under the general permission, is not required to file any documents with the Reserve Bank.

In terms of Regulation 5A of the Foreign Exchange Management (Acquisition and Transfer of Immovable Property in India) Regulations 2000, Foreign Embassy/ Diplomat/ Consulate General, may purchase/ sell immovable property (other than agricultural land/ plantation property/ farm house) in India provided –

Clearance from the Government of India, Ministry of External Affairs is obtained for such purchase/sale, and The consideration for acquisition of immovable property in India is paid out of funds remitted from abroad through the normal banking channels.

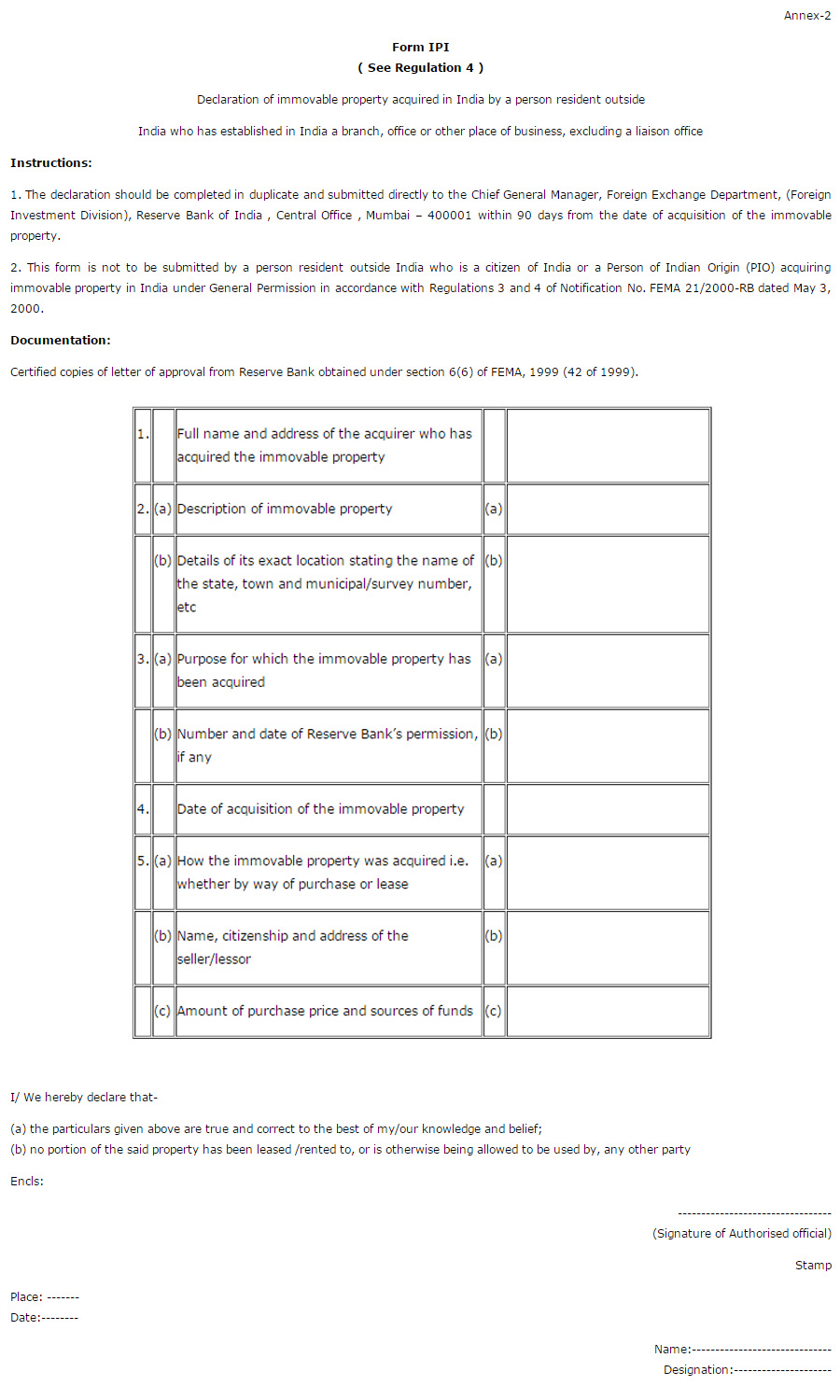

A person resident outside India who has established a Branch, Office or other place of business, excluding a Liaison Office, for carrying on in India any activity in accordance with the Foreign Exchange Management (Establishment in India of Branch or Office or other Place of Business) Regulations, 2000 may –

acquire any immovable property in India, which is necessary for or incidental to carrying on such activity, provided that all applicable laws, rules, regulations or directions for the time being in force are duly complied with; and the person files with the Reserve Bank a declaration in the form IPI (Annex-2), not later than ninety days from the date of such acquisition; and transfer by way of mortgage to an Authorised Dealer as a security for any borrowing, the immovable property acquired in pursuance of clause (a) above.

(A) Immovable property acquired by way of purchase

(a) A person referred to in sub-section (5) of Section 6 of the Foreign Exchange Management Act3 , or his successor shall not, except with the prior permission of the Reserve Bank, repatriate outside India the sale proceeds of any immovable property referred to in that sub-section.

(b) In the event of sale of immovable property other than agricultural land / farm house / plantation property in India by a person resident outside India who is a citizen of India or a person of Indian origin, the Authorised Dealer may allow repatriation of the sale proceeds outside India, provided the following conditions are satisfied, namely:

(i) the immovable property was acquired by the seller in accordance with the provisions of the foreign exchange law in force at the time of acquisition by him or the provisions of these Regulations;

(ii) the amount to be repatriated does not exceed:

the amount paid for acquisition of the immovable property in foreign exchange received through normal banking channels, or

the amount paid out of funds held in Foreign Currency Non-Resident Account, or

the foreign currency equivalent (as on the date of payment) of the amount paid where such payment was made from the funds held in Non-Resident External account for acquisition of the property; and

(iii) in the case of residential property, the repatriation of sale proceeds is restricted to maximum two such properties.

(B) Immovable property acquired by way of inheritance/ legacy/ out of Rupee funds

A Non-Resident Indian (NRI) / Person of Indian Origin (PIO) may remit an amount, not exceeding US $ 1,000,000 (US Dollar One million only) per financial year out of the balances held in NRO accounts / sale proceeds of assets by way of purchase / the assets in India acquired by him by way of inheritance / legacy/ out of Rupee funds. This is subject to production of documentary evidence in support of acquisition, inheritance or legacy of assets by the remitter, and a tax clearance / no objection certificate from the Income Tax Authority for the remittance. Remittances exceeding US $ 1,000,000 (US Dollar One million only) in any financial year requires prior permission of the Reserve Bank.

In cases of deed of settlement made by either of his parents or a close relative (as defined in Section 6 of the Companies Act, 1956) and the settlement taking effect on the death of the settler, the original deed of settlement and a tax clearance / No objection certificate from the Income-Tax Authority should be produced for the remittance.

Where the remittance as above is made in more than one installment, the remittance of all such installments shall be made through the same Authorised Dealer.

Refund of application / earnest money / purchase consideration made by the house building agencies / seller on account of non-allotment of flat / plot / cancellation of bookings / deals for purchase of residential / commercial property, together with interest, if any (net of income tax payable thereon) may be allowed by the Authorised Dealers by way of credit to NRE/FCNR (B) account, provided the original payment was made out of NRE / FCNR (B) account of the account holder or remittance from outside India through normal banking channels and the Authorised Dealer is satisfied about the bonafides of the transaction.

No person being a citizen of Pakistan, Bangladesh, Sri Lanka, Afghanistan, China, Iran, Nepal or Bhutan without prior permission of the Reserve Bank shall acquire or transfer immovable property in India, other than lease, not exceeding five years.

Foreign nationals of non-Indian origin resident outside India are not permitted to acquire any immovable property in India unless such property is acquired by way of inheritance from a person who was resident in India. However, they can acquire or transfer immovable property in India, on lease, not exceeding five years without the prior permission of the Reserve Bank.

Foreign Nationals of non-Indian origin, other than a citizen of Pakistan, Bangladesh, Sri Lanka, Afghanistan, China, Iran, Nepal or Bhutan, can acquire immovable property in India on becoming resident in India in terms of Section 2(v) of the Foreign Exchange Management Act, 1999. In this connection, he has to satisfy the condition of period of stay. The type of visa granted should clearly indicate the intention to stay in India for an uncertain period to determine his residential status in terms of section 2(v) FEMA, 1999. (Press Release dated February 1, 2009 issued by Government of India is enclosed as Annex-1).

Foreign nationals of non-Indian origin who have acquired immovable property in India by way of inheritance with the specific approval of the Reserve Bank or have purchased the immovable property with the specific approval of the Reserve Bank cannot transfer such property without the prior permission of the Reserve Bank.

| Sr. No. | Notification / Circular | Date |

| 1 | FEMA 21/2000-RB | May 3, 2000 |

| 2 | FEMA 62/2002-RB | May 13, 2002 |

| 3 | FEMA 65/2002-RB | June 29, 2002 |

| 4 | FEMA 64/2002-RB | June 29, 2002 |

| 5 | FEMA 93/2003-RB | June 9, 2003 |

| 6 | FEMA 146/2006-RB | February 10, 2006 |

| 7 | FEMA 200/2009-RB | October 5, 2009 |

| 1 | A.P.(DIR Series) Circular No.1 | July 2, 2002 |

| 2 | A.P.(DIR Series) Circular No.5 | July 15, 2002 |

| 3 | A.P.(DIR Series) Circular No.19 | September 12, 2002 |

| 4 | A.P.(DIR Series) Circular No.35 | November 1, 2002 |

| 5 | A.P.(DIR Series) Circular No.46 | November 12, 2002 |

| 6 | A.P.(DIR Series) Circular No.27 | September 28, 2002 |

| 7 | A.P.(DIR Series) Circular No.56 | November 26, 2002 |

| 8 | A.P.(DIR Series) Circular No.67 | January 13, 2003 |

| 9 | A.P.(DIR Series) Circular No.19 | September 23, 2003 |

| 10 | A.P.(DIR Series) Circular No. 5 | August 16, 2006 |

| 11 | A.P.(DIR Series) Circular No.25 | January 13, 2010 |

| 12 | A.P. (DIR Series) Circular No. 79 | February 15, 2012 |

Acquisition of immovable property in India by persons resident outside India (foreign national) is regulated in terms of section 6 (3) (i) of the Foreign Exchange Management Act (FEMA), 1999 as well as by the regulations contained in the Notification No. FEMA 21/2000-RB dated May 3, 2000, as amended from time to time. Section 2 (v) and Section 2 (w) of FEMA, 1999 defines `person resident in India' and a `person resident outside India', respectively. Person resident outside India is categorized as Non- Resident Indian (NRI) or a foreign national of Indian Origin (PIO) or a foreign national of non-Indian origin. The Reserve Bank does not determine the residential status. Under FEMA, residential status is determined by operation of law. The onus is on an individual to prove his / her residential status, if questioned by any authority.

2. In terms of the provisions of Section 6(5) of FEMA 1999, a person resident outside India can hold, own, transfer or invest in Indian currency, security or any immovable property situated in India if such currency, security or property was acquired, held or owned by such person when he was a resident in India or inherited from a person who was a resident in India.

3. The regulations under Notification No. FEMA 21/2000-RB dated May 3, 2000, as amended from time to time, permit a NRI or a PIO to acquire immovable property in India, other than agricultural land or, plantation property or farm house. Further, foreign companies who have been permitted to open a Branch or Project Office in India are also allowed to acquire any immovable property in India, which is necessary for or incidental to carrying on such activity. Such dispensation is however not available to entities which are permitted to open liaison offices in India.

4. The restrictions on acquiring immovable property in India by a person resident outside India would not apply where the immovable property is proposed to be acquired by way of a lease for a period not exceeding 5 years or where a person is deemed to be resident in India.

In order to be deemed to be a person resident in India, from FEMA angle, the person would need to comply with the provisions of Section 2(v) of FEMA 1999. The Press Release dated February 1, 2009 issued by Government of India in this regard is enclosed as Annex.

Note: Citizens of Pakistan, Bangladesh, Sri Lanka, Afghanistan, China, Iran, Nepal or Bhutan cannot acquire or transfer immovable property in India, (other than on lease not exceeding five years) without the prior permission of the Reserve Bank.

5. NRIs/ PIOs are allowed to repatriate an amount up to USD one million, per financial year (April-March), out of the balances held in the Non-Resident (Ordinary) Rupee (NRO) account, subject to compliance with applicable tax requirements. This amount includes sale proceeds of assets acquired by way of inheritance or settlement.

6. The FAQs cover the following topics :

A. Acquisition of Immovable Property in India by a person resident outside India, i.e., by a NRI / PIO / foreign national of non-Indian origin by way of purchase / gift / inheritance.

i) sale

ii) gift

iii) mortgage

i) purchased

ii) gift

iii) inheritance

Ans. Under the general permission available, the following categories can purchase immovable property in India:

i) Non-Resident Indian (NRI)1[1][1][1]

ii) Person of Indian Origin (PIO)2[2][2]

The general permission, however, covers only purchase of residential and commercial property and is not available for purchase of agricultural land / plantation property / farm house in India.

Ans. No.

Ans. No. An NRI / PIO who has purchased residential / commercial property under general permission, is not required to file any documents/reports with the Reserve Bank.

Ans. There are no restrictions on the number of residential / commercial properties that can be purchased.

Ans. No.

Ans. No. A foreign national of non-Indian origin, resident outside India cannot purchase any immovable property in India unless such property is acquired by way of inheritance from a person who was resident in India. However, he / she can acquire or transfer immovable property in India, on lease, not exceeding five years. In such cases, there is no requirement of taking any permission of /or reporting to the Reserve Bank.

Ans. Yes, a foreign national who is a ‘person resident in India’ within the meaning of Section 2(v) of FEMA, 1999 can purchaseimmovable property in India, but the person concerned would have to obtain the approvals and fulfil the requirements, if any, prescribed by other authorities, such as, the State Government concerned, etc. The onus to prove his/her residential status is on the individual as per the extant FEMA provisions, if required by any authority. However, a foreign national resident in India who is a citizen of Pakistan, Bangladesh, Sri Lanka, Afghanistan, China, Iran, Nepal and Bhutan would require prior approval of the Reserve Bank.

Ans. A foreign company which has established a Branch Office or other place of business in India, in accordance with the Foreign Exchange Management (Establishment in India of Branch or Office or other Place of Business) Regulations, 2000, can acquire any immovable property in India, which is necessary for or incidental to carrying on such activity. The payment for acquiring such a property should be made by way of foreign inward remittance through the proper banking channels. A declaration in form IPI should be filed with the Reserve Bank within ninety days from the date of acquiring the property. Such a property can also be mortgaged with an Authorised Dealer as a security for the purpose of borrowings. On winding up of the business, the sale proceeds of such property can be repatriated only with the prior approval of the Reserve Bank. Further, acquisition of immovable property by entities incorporated in Pakistan, Bangladesh, Sri Lanka, Afghanistan, China, Iran, Nepal and Bhutan and who have set up Branch Offices in India and would require prior approval of the Reserve Bank.

However, if the foreign company has established a Liaison Office in India, it cannot acquire immovable property. In such cases, Liaison Offices can acquire property by way of lease not exceeding 5 years.

Ans. (a) Yes, NRIs and PIOs can freely acquire immovable property by way of gift either from

i) a person resident in India; or

ii) an NRI; or

However, the property can only be commercial or residential in nature. Agricultural land / plantation property / farm house in India cannot be acquired by way of gift

(b) A foreign national of non-Indian origin resident outside India cannot acquire any immovable property in India by way of gift.

Ans. Yes, a person resident outside India i.e. i) an NRI; ii) a PIO; and iii) a foreign national of non-Indian origin can inherit and hold immovable property in India from a person who was resident in India.

Ans. A person resident outside India (i.e. NRI or PIO or foreign national of non-Indian origin) can inherit immovable property from

(a) a person resident in India

(b) a person resident outside India

However, the person from whom the property is inherited should have acquired the same in accordance with the foreign exchange law in force or FEMA regulations, applicable at the time of acquisition of the property.

B. Transfer of immovable property in India

(i) Transfer by way of sale

Ans. (a) NRI can sell property in India to

i) a person resident in India; or

ii) an NRI; or

iii) a PIO.

(b) PIO can sell property in India to

i) a person resident in India; or

ii) an NRI; or

iii) a PIO – with the prior approval of the Reserve Bank

(c) Foreign national of non-Indian origin including a citizen of Pakistan or Bangladesh or Sri Lanka or Afghanistan or China or Iran or Nepal or Bhutan can sell property in India with prior approval of the Reserve Bank to

i) a person resident in India

ii) an NRI

iii) a PIO

Ans. (a) NRI / PIO may sell agricultural land /plantation property/farm house to a person resident in India who is a citizen of India.

(b) Foreign national of non-Indian origin resident outside India would need prior approval of the Reserve Bank to sell agricultural land/plantation property/ farm house in India.

(ii) Transfer by way of gift

Ans. Yes.

(a) NRI / PIO may gift residential / commercial property to

(i) person resident in India or

(ii) an NRI or

(iii) PIO.

(b) A foreign national of non-Indian origin requires the prior approval of the Reserve Bank for gifting the residential / commercial property.

Ans. (a) NRI / PIO can gift an agricultural land / a plantation property / a farm house in India only to a person resident in India who is a citizen of India.

(b) A foreign national of non-Indian origin would require the prior approval of the Reserve Bank to gift an agricultural land / a plantation property / a farm house in India.

(iii) Transfer through mortgage

Ans. i) NRI / PIO can mortgage a residential / commercial property to:

(a) an Authorised Dealer / the housing finance institution in India without the approval of Reserve Bank

(b) a bank abroad, with the prior approval of the Reserve Bank.

ii) A foreign national of non-Indian origin can mortgage a residential / commercial property only with prior approval of the Reserve Bank.

iii) A foreign company which has established a Branch Office or other place of business in accordance with FERA/FEMA regulations has general permission to mortgage the property with an Authorised Dealer in India.

C. Mode of payment for purchase of immovable property in India.

Ans. Payment can be made by NRI / PIO out of:

(a) funds remitted to India through normal banking channels or

(b) funds held in NRE / FCNR (B) / NRO account maintained in India

No payment can be made either by traveller’s cheque or by foreign currency notes or by other mode except those specifically mentioned above.

Ans. The Authorised Dealers can allow NRIs / PIOs to creditrefund of application/ earnest money/ purchase consideration made by the house building agencies/ seller on account of non-allotment of flat/ plot/ cancellation of bookings/ deals for purchase of residential, commercial property, together with interest, if any, net of income tax payable thereon, to NRE/FCNR account, provided, the original payment was made out of NRE/FCNR account of the account holder or remittance from outside India through normal banking channels and the Authorised Dealer is satisfied about the genuineness of the transaction.

Ans. Yes, such loans are permitted subject to the terms and conditions laid down in Schedules 1 and 2 to the Notification No. FEMA 5/2000-RB dated May 3, 2000 viz. Foreign Exchange Management (Deposit) Regulations, 2000, as amended from time to time. Banks cannot grant fresh loans or renew existing loans in excess of Rs. 100 lakhs against NRE and FCNR (B) deposits, either to the depositors or to third parties. The banks should also not undertake artificial slicing of the loan amount to circumvent the ceiling of Rs. 100 lakh.

Such loans can be repaid in the following manner:

(a) by way of inward remittance through normal banking channel or

(b) by debit to the NRE / FCNR (B) / NRO account of the NRI/ PIO or

(c) out of rental income from such property

(d) by the borrower's close relatives, as defined in section 6 of the Companies Act, 1956, through their account in India by crediting the borrower's loan account.

Ans. Yes, NRI/PIO can avail of housing loan in Rupees from an Authorised Dealer or a Housing Finance Institution subject to certain terms and conditions laid down in Regulation 8 of Notification No. FEMA 4/2000-RB dated May 3, 2000 viz. Foreign Exchange Management (Borrowing and lending in rupees) Regulations, 2000, as amended from time to time. Authorised Dealers/ Housing Finance Institutions can also lend to the NRIs/ PIOs for the purpose of repairs/renovation/ improvement of residential accommodation owned by them in India.Such a loan can be repaid

(a) by way of inward remittance through normal banking channel or

(b) by debit to the NRE / FCNR

(B) / NRO account of the NRI / PIO or

(c) out of rental income from such property; or

(d) by the borrower's close relatives, as defined in section 6 of the Companies Act, 1956, through their account in India by crediting the borrower's loan account.

Ans. Yes, subject to certain terms and conditions given in Regulation 8A of Notification No. FEMA 4/2000-RB dated May 3, 2000 and A.P. (DIR Series) Circular No.27 dated October 10, 2003, i.e.,

(i) The loan shall be granted only for personal purposes including purchase of housing property in India; (ii) The loan shall be granted in accordance with the lender’s Staff Welfare Scheme/Staff Housing Loan Scheme and subject to other terms and conditions applicable to its staff resident in India;

(iii) The lender shall ensure that the loan amount is not used for the purposes specified in sub-clauses (i) to (iv) of clause (1) and in clause (2) of Regulation 6 of Notification No.FEMA.4/2000-RB dated May 3, 2000.

(iv) The lender shall credit the loan amount to the borrower’s NRO account in India or shall ensure credit to such account by specific indication on the payment instrument;

(v) The loan agreement shall specify that the repayment of loan shall be by way of remittance from outside India or by debit to NRE/NRO/FCNR Account of the borrower and the lender shall not accept repayment by any other means.

D. Repatriation of sale proceeds of residential / commercial property purchased by NRI / PIO

Ans. (a) In the event of sale of immovable property other than agricultural land / farm house / plantation property in India by a NRI / PIO, the Authorised Dealer may allow repatriation of the sale proceeds outside India, provided the following conditions are satisfied, namely:

(i) the immovable property was acquired by the seller in accordance with the provisions of the foreign exchange law in force at the time of acquisition by him or the provisions of these Regulations;

(ii) the amount to be repatriated does not exceed:

· the amount paid for acquisition of the immovable property in foreign exchange received through normal banking channels, or

· the amount paid out of funds held in Foreign Currency Non-Resident Account, or

· the foreign currency equivalent (as on the date of payment) of the amount paid where such payment was made from the funds held in Non-Resident External account for acquisition of the property; and

(iii) in the case of residential property, the repatriation of sale proceeds is restricted to not more than two such properties.

For this purpose, repatriation outside India means the buying or drawing of foreign exchange from an authorised dealer in India and remitting it outside India through normal banking channels or crediting it to an account denominated in foreign currency or to an account in Indian currency maintained with an authorised dealer from which it can be converted in foreign currency.

(b) in case the property is acquired out of Rupee resources and/or the loan is repaid by close relatives in India (as defined in Section 6 of the Companies Act, 1956), the amount can be credited to the NRO account of the NRI/PIO. The amount of capital gains, if any, arising out of sale of the property can also be credited to the NRO account.

NRI/PIO are also allowed by the Authorised Dealers to repatriate an amount up to USD 1 million per financial year out of the balance in the NRO account / sale proceeds of assets by way of purchase / the assets in India acquired by him by way of inheritance / legacy. This is subject to production of documentary evidence in support of acquisition, inheritance or legacy of assets by the remitter, and a tax clearance / no objection certificate from the Income Tax Authority for the remittance. Remittances exceeding US $ 1,000,000 (US Dollar One million only) in any financial year requires prior permission of the Reserve Bank.

(c) A person referred to in sub-section (5) of Section 6 of the Foreign Exchange Management Act 3[3][3], or his successor shall not, except with the prior permission of the Reserve Bank, repatriate outside India the sale proceeds of any immovable property referred to in that sub-section.

Ans. Please refer to the answer at Q.22 above. NRI/PIO may repatriate up to USD one million per financial year (April-March) from their NRO account which would also include the sale proceeds of immovable property. There is no lock in period for sale of immovable property and repatriation of sale proceeds outside India.

Ans. Yes, Authorised Dealers have been authorised to allow repatriation of sale proceeds of residential accommodation purchased by NRIs/ PIOs out of funds raised by them by way of loans from the authorised dealers/ housing finance institutions to the extent such loan/s repaid by them are out of the foreign inward remittances received through normal banking channel or by debit to their NRE/FCNR accounts. The balance amount, if any, can be credited to their NRO account and the NRI/PIO may repatriate up to USD one million per financial year (April-March) subject to payment of applicable taxes from their NRO account balances which would also include the sale proceeds of the immovable property.

Ans. The sale proceeds of immovable property acquired by way of gift should be credited to NRO account only. From the balance in the NRO account, NRI/PIO may remit up to USD one million, per financial year, subject to the satisfaction of Authorised Dealer and payment of applicable taxes.

Ans. Yes, general permission is available to the NRIs/PIO to repatriate the sale proceeds of the immovable property inherited from a person resident in Indiasubject to thefollowing conditions:

(i) The amount should not exceed USD one million, per financial year

(ii) This is subject to production of documentary evidence in support of acquisition / inheritance of assets and an undertaking by the remitter and certificate by a Chartered Accountant in the formats prescribed by the Central Board of Direct Taxes vide their Circular No.4/2009 dated June 29, 2009

(iii) In cases of deed of settlement made by either of his parents or a close relative (as defined in section 6 of the Companies Act, 1956) and the settlement taking effect on the death of the settler

(iv) the original deed of settlement and a tax clearance / No Objection Certificate from the Income-Tax Authority should be produced for the remittance

(v) Where the remittance as above is made in more than one installment, the remittance of all such installments shall be made through the same Authorised Dealer

(vi) In case of a foreign national, sale proceeds can be repatriated if the property is inherited from a person resident outside India with the prior approval of the Reserve Bank. The foreign national has to approach the Reserve Bank with documentary evidence in support of inheritance of the immovable property and the undertaking and the C.A. Certificate mentioned above.

The general permission for repatriation of sale proceeds of immovable property is not available to a citizen of Pakistan, Bangladesh, Sri Lanka, China, Afghanistan and Iran and he has to seek specific approval of the Reserve Bank.

As FEMA, 1999 specifically permits transactions only in Indian Rupees with citizens of Nepal and Bhutan. Therefore, the question of repatriation of the sale proceeds in foreign exchange to Nepal and Bhutan would not arise.

E. Provisions for Foreign Embassies / Diplomats / Consulates General

Ans. In terms of Regulation 5A of the Foreign Exchange Management (Acquisition and Transfer of Immovable Property in India) Regulations 2000, Foreign Embassies/ Diplomats/ Consulates General, may purchase/ sell immovable property (other than agricultural land/ plantation property/ farm house) in India provided –

(i) Clearance from the Government of India, Ministry of External Affairs has been obtained for such purchase/sale; and

(ii) The consideration for acquisition of immovable property in India is paid out of funds remitted from abroad through the normal banking channels.

F. Other Aspects

Ans. Yes, NRI/PIO can rent out the property without the approval of the Reserve Bank. The rent received can be credited to NRO / NRE account or remitted abroad. Powers have been delegated to the Authorised Dealers to allow repatriation of current income like rent, dividend, pension, interest, etc. of NRIs/PIO who do not maintain an NRO account in India based on an appropriate certification by a Chartered Accountant, certifying that the amount proposed to be remitted is eligible for remittance and that applicable taxes have been paid/provided for.

Ans. Yes, a person who had bought the residential / commercial property / agricultural land/ plantation property / farm house in India when he was a resident, continue to hold the immovable property without the approval of the Reserve Bank even after becoming an NRI/PIO. The sale proceeds may be credited to NRO account of the NRI /PIO.

Ans. Yes, From the balance in the NRO account, NRI/PIO may remit up to USD one million, per financial year, subject to the satisfaction of Authorised Dealer and payment of applicable taxes.

Ans. Yes, they may continue to hold the immovable property under holding license obtained from the Reserve Bank. However, they can transfer the property only with the prior approval of the Reserve Bank.

Ans. A person resident in India who is a citizen of Pakistan or Bangladesh or Sri Lanka or Afghanistan or China or Iran or Nepal or Bhutan is governed by the provisions of Foreign Exchange Management (Acquisition and Transfer of Immovable Property in India) Regulations, 2000, as amended from time to time, i.e. she/he would require prior approval of the Reserve Bank for acquisition and transfer of immovable property in India even though she/he is resident in India. Such requests are considered by the Reserve Bank in consultation with the Government in India.

The citizens of countries other than those listed above can be PIOs who are covered under the general permission (please refer to Q.No.1). The provisions relating to foreign national of non-Indian origin are covered in detail in Q Nos. 6 and 7. Note:

The relevant regulations covering the transactions in immovable property have been notified vide RBI Notification No. FEMA 21/2000-RB dated May 3, 2000 and this basic notification has been subsequently amended by the notifications detailed below:

i) Notification No.FEMA 64/2002-RB dated June 29, 2002;

ii) Notification No.FEMA 65/2002-RB dated June 29, 2002;

iii) Notification No.FEMA 93/2003-RB dated June 9, 2003;

iv) Notification No. FEMA 146/2006-RB dated February 10, 2006 read with A.P.(DIR Series) Circular No. 5 dated 16.8.2006; and

v) Notification No. FEMA 200/2009-RB dated October 5, 2009

All the above notifications and A.P. (DIR Series) Circulars are available on the RBI website: www.fema.rbi.org.in. The Master Circular on Acquisition and Transfer of Immovable Property in India by NRIs/PIOs/Foreign Nationals of Non-Indian Origin is also available on the website under the link “www.rbi.org.in ® Sitemap ® Master Circulars”.